Roth Limits 2025 Income

Roth Limits 2025 Income. The amount you can contribute to a roth ira might be less than the year’s ira contribution limit (and possibly $0) if. 2025 roth ira contribution limits.

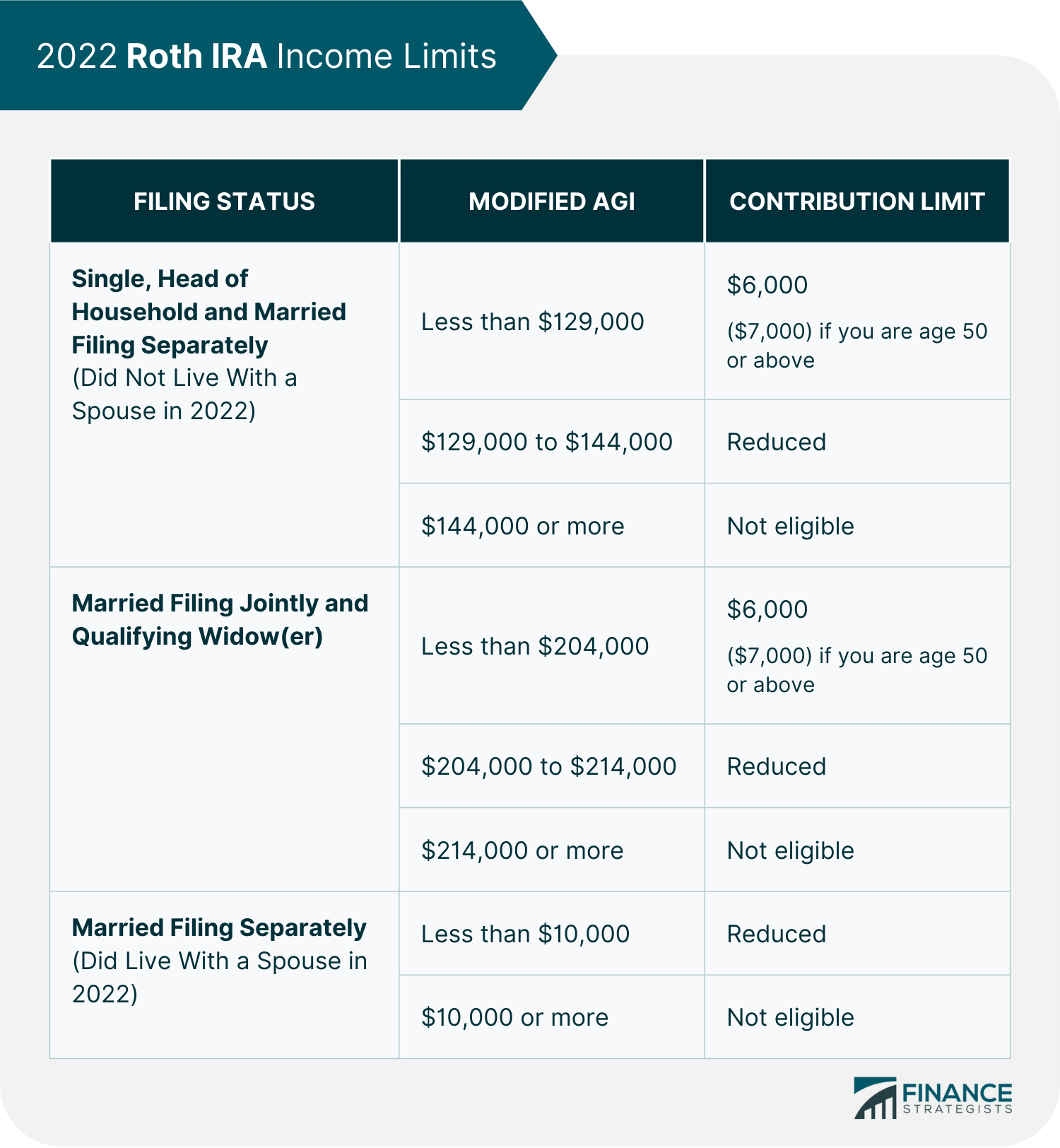

Here are the roth ira income limits for 2025 that would reduce your contribution to zero: Deducting charitable contributions may be subject to adjusted gross income (agi) limits depending on the receiving charity and what you donated.

Contribution limits are enforced across traditional iras and roth iras, but income limits only apply.

Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full.

IRA Contribution Limits 2025 Finance Strategists, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. If you are 50 and older, you can contribute an additional.

Roth IRA Limits for 2025 Personal Finance Club, Roth ira rules 2025 and 2025: If you are 50 and older, you can contribute an additional.

What is a Roth IRA? The Fancy Accountant, Roth ira income limits for 2025 brokerage products: The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if.

Limit For Roth Ira 2025 Arleen Michelle, 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000, internal. What are the roth ira income limits for 2025?

Roth Ira Conversion Limits 2025 Casie Cynthia, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. The roth ira income limits will increase in 2025.

2025 Roth Limit Rory Walliw, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. After your income surpasses that, you'll.

IRA Contribution Limits in 2025 Meld Financial, For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000, internal.

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, The amount you can contribute to a roth ira might be less than the year’s ira contribution limit (and possibly $0) if. Is your income ok for a roth ira?

Limit For Roth Ira Contribution 2025 Lynn Sondra, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

Roth IRA contribution limits aving to Invest, 2025 roth ira contribution limits and income limits. “verified by an expert” means that this article.

The amount you can contribute to a roth ira might be less than the year’s ira contribution limit (and possibly $0) if.

The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.